are nursing home expenses tax deductible in canada

Unfortunately this definition is a bit vague so that once your presenceabsence in Canada starts getting near to 5050 it starts to become questionable as to whether youre ordinarily living in Canada. Exempt from paying income tax for religious.

Can You Claim A Tax Deduction For Assisted Living The Arbors

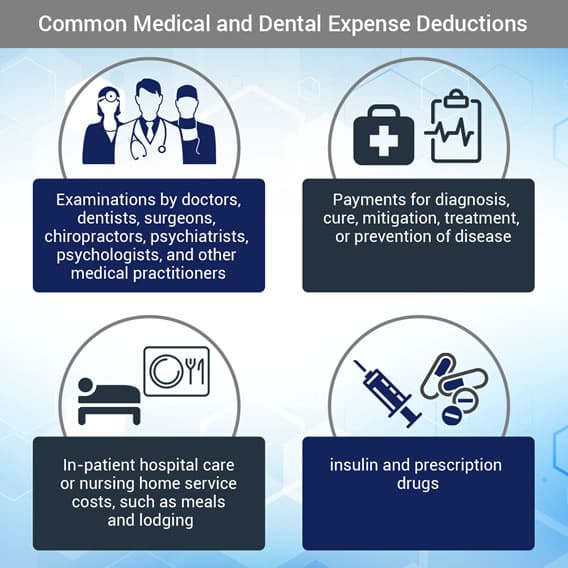

The medical expense tax credit is one of the most overlooked non-refundable tax deductions.

. For OASGIS purposes residing in Canada is defined as making your home in Canada and ordinarily living in Canada. Calculating the medical expense tax credit. Last year 500 of her home operating costs could be attributed to her office.

The national government is responsible for setting health care priorities and monitoring access quality and costs. However if the resident is chronically ill andin the facility primarily for medical care and the care is being performed according to a certified care plan then the room and board may be considered part of the medical care and the cost may be. Quotes include the Early Bird Special.

As used in this title unless the context otherwise requires or a different meaning is specifically prescribed health insurance policy means insurance providing benefits due to illness or injury resulting in loss of life loss of earnings or expenses incurred and includes the following types of coverage. Taiwan introduced controlled foreign company rules to the Income Tax Act ITA in 2016. Line 33099 You can claim the total eligible medical expenses you or your spouse or common-law partner paid for any of the following persons.

Costs are deductible if the education is either required for continued employment by law or the individuals employer or maintains or improves the skills required in the individuals current trade or business. For more detail about the deductibility of self-education expenses see TR 989 Income tax. You can generally include qualified medical expenses you pay for yourself as well as those you pay for your spouse andor dependent.

Home nursing care must be provided by a registered nurse or licensed practical nurse who is not a relative of the patient. The deduction of sales tax only benefits a person with one or more large purchases for the tax yearsuch as a car boat RV or home additionthat led to a greater amount of sales tax. Legal fees paid to authorize treatment for mental illness.

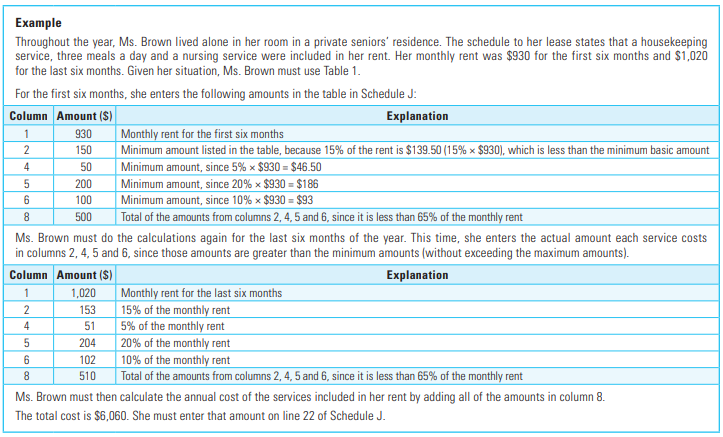

The costs of qualified long-term care including nursing home care are deductible as medical expenses. These tend to be exorbitant but fortunately for you some expenses are deductible. Under the formula the lowest tax rate percentage 15 for years after 2006 is multiplied by the total of two calculated amountsThe first calculated amount relates to medical expenses paid in respect of the.

If you think this might apply to you be sure to contact a tax. Your or your spouses or common-law partners. COVID-19 coverage is included if you have been vaccinated including any subsequent doses of the vaccine if available to you.

There are 5 categories that we place self-education or study expenses in to. Francesca is a real estate agent who has a qualifying home office. You can also invest your money and gain higher interest as you will be charged less tax than others.

If all of your self-education or study expenses are from category A then you have to reduce. Tax Credits In some cases educational expenses may be tax-deductible. Lodging expenses while away from home to receive medical care in a hospital or medical facility.

This tax credit can also be claimed for your spouse common-law partner and children under 18 years of age. Long-term care insurance and long-term care expenses. Health insurance premiums and prescription drugs and nursing care etc.

Long-term Care Expenses Nursing Homes. Standard benefits include hospital physician home nursing and mental health care as well as prescription drugs. Household help for nursing care services.

Since these expenses are an ordinary and necessary part of operating your business they are deductible on your Schedule C and should not be overlooked when you prepare your taxes. While you may have heard that medical expenses are deductible on your personal income tax return you may be wondering exactly which expenses qualify. Your spouse or common-law partner.

250 reduction in expenses. One of these is your medical and dental expenses. How to claim medical expenses.

Are some of these deductible expenses. Generally only the medical component of assisted living costs is deductible and ordinary living costs like room and board are not. Financing is primarily public through premiums tax revenues and government grants.

Although most Canadians are aware that the medical expense tax credit exists many fail to keep the necessary receipts or running tally of expenses. A 50 annual deductible is applied to the total of all eligible health benefit expenses incurred in a benefit year except for prescription drugs and diabetes supplies. Deductibility of self-education expenses incurred by an employee or a person in business.

11 An individual may claim a medical expense tax credit for the amount determined by the formula in subsection 11821. Lead-based paint removal when a child is diagnosed with lead poisoning. You can claim medical expenses on line 33099 or 33199 of your tax return under Step 5 Federal tax.

Changes to the Child Tax Credit Explained. If a Taiwan company holds 50 or more of the shares of a company in a low-tax offshore jurisdiction or otherwise maintains significant control of the companys operations the Taiwan company must include its respective share of the offshore companys earnings. PART I HEALTH INSURANCE.

How To Claim Expenses As An Employee

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

How To Deduct Your Medical Expenses 2022 Turbotax Canada Tips

The Professional Development Tax Deduction What You Need To Know

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

How To Deduct Medical Expenses On Your Taxes Smartasset

What To Know About Deductible Medical Expenses E File Com

Medical Expenses Eligible For Deduction On Your 2019 Tax Return Think Accounting

Nursing Home Expense Tax Deductions

Tax Deductible Medical Expenses In Canada Groupenroll Ca

Dt Max Line 458 Tax Credit For Home Support Services For Seniors

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Insurance Deductible Tracker One Beautiful Home Insurance Deductible Health Insurance Plans Medical Insurance

Are Medical Expenses Tax Deductible

Can You Deduct Travel Expenses In Canada Youtube

Track Medical Bills With The Medical Expenses Spreadsheet Medical Billing Medical Expense Tracker Medical

What To Know About Deductible Medical Expenses E File Com